Pliant x Commerzbank, The digital credit card solution for your business

Simple. Automated. Integrated., Your benefits at a glance

Optimise payment processes for your digital corporate credit cards with Pliant x Commerzbank. With our card management platform, you can issue your own virtual corporate credit cards and use them right away. As well as allowing you to adjust card limits flexibly, our platform provides real-time reporting and can be integrated seamlessly with your existing accounting and travel expense management tools.

VISA credit card

Worldwide acceptance, high limits and other premium benefits

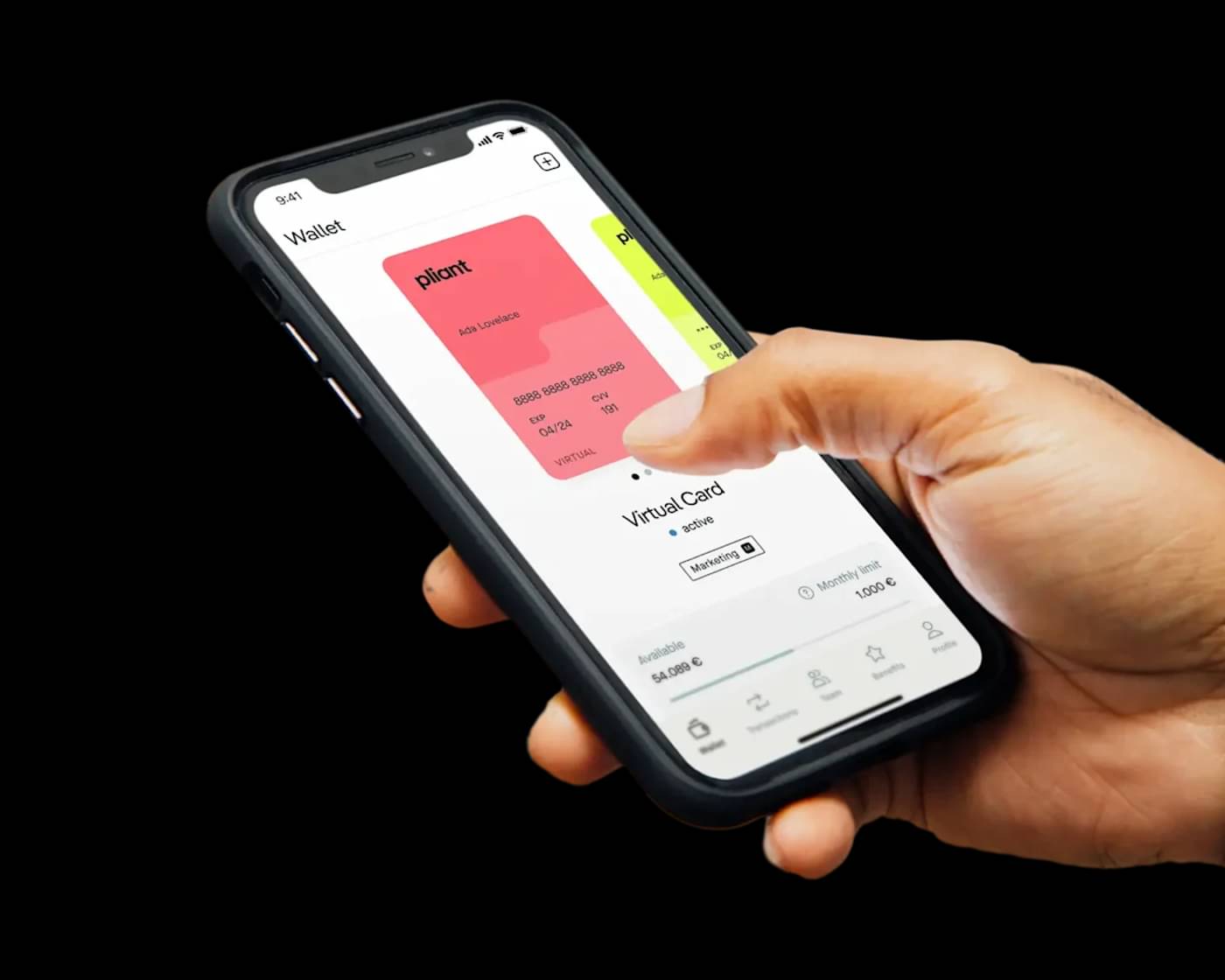

All-in-one app

Create, manage and track transactions with our mobile and web app

Complete control

Easy to manage limits and control spending for individual departments

Plug-and-play

Virtual corporate credit cards can be provided to any number of employees right away

Usable with existing accounts

You can use your existing corporate bank account with Commerzbank and start right away

Efficient accounting

Automated payment processes and seamless integration with most accounting and financial tools

Whom are virtual corporate credit cards worthwhile for?

Pliant’s credit card solutions are designed above all for:

- International corporate clients who want to issue credit cards to multiple employees and manage limits easily, quickly and flexibly

- Companies that would like to handle expenses incurred by different departments using separate cards and want to assign them immediately and invoice them transparently (e.g. expenses for Google Ads separate from expenses for business trips, etc.)

Manage your costs more efficiently in just four steps, The efficient credit card solution from Pliant

Fill in contact form

Fill in the contact form and let us know your initial requirements.

Personal consultation with Pliant

Find out more in a personal consultation complete with live demonstration.

Accept offer

Receive and confirm a personalised offer.

Onboarding

The onboarding team will guide you through the set-up process.

Pliant: The modern credit card solution for corporate clients

Pliant provides fast and easy access to modern corporate credit cards. This digital card solution allows you to use your existing corporate account and your preferred accounting and finance solutions. The following services are possible with Pliant:

- Issuing corporate credit cards for any number of employees

- Managing credit cards and users online

- Setting card limits, validity periods and restrictions flexibly, for example for transaction categories or merchants/retailers

- Real-time reporting and expense tracking

- Automated invoice matching

- Integrating existing accounting and travel expense tools seamlessly

Virtual credit cards: Available right away with customisable options for every application

With the Pliant virtual corporate credit card solution, you won’t need a physical card. Instead, you can use and manage your virtual card digitally via the Pliant app, which offers a whole host of advantages. As a Pliant customer, you can issue virtual credit cards free of charge, so it is easy to assign separate cards for employees from different departments with individual settings. The virtual cards are ready to use, flexible and protected against loss. This means that you can issue virtual credit cards or single-use cards for specific purposes, such as trade fairs. As well as this, companies can view and manage the purchases of individual departments and employees transparently at any time.