Financing , Guarantees: hedging your contracting partners' risks

Guarantees, At a glance

- We will issue exactly the right type of guarantee – made to measure to fit your needs – to protect any of your underlying transactions1.

- Should various or different guarantees spark your interest, we'd be happy to advise you on the conclusion of a guarantee line agreement which will offer you a high degree of flexibility.

- All types of guarantees can be drawn only for sums of money, and not for the performance of services.

How you can benefit from guarantees, A safety net for your clients, a good solution for you

High potential

Guarantees preserve your own liquidity, whilst opening up new business opportunities.

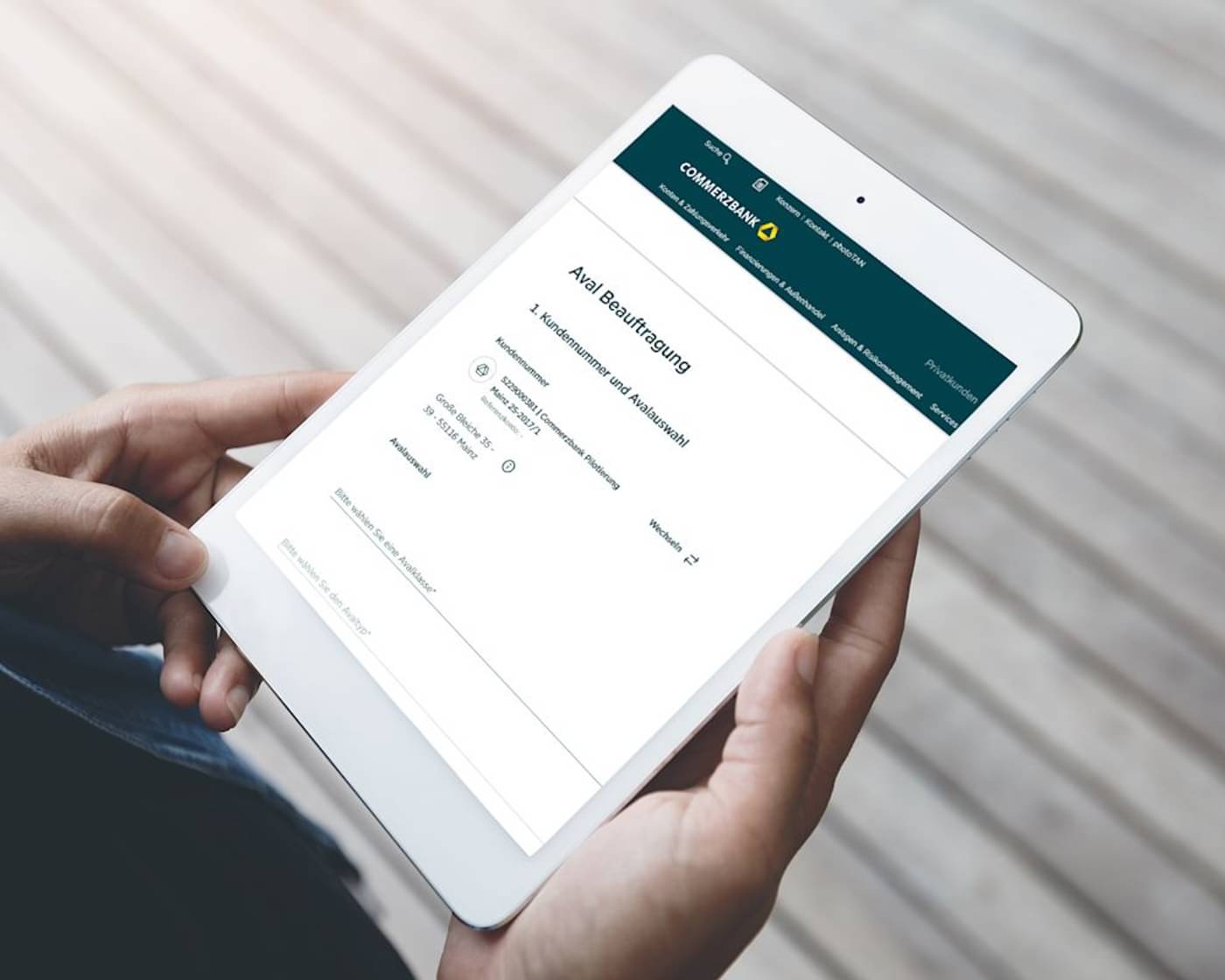

Digital comfort

Create and amend guarantee orders digitally in our corporate client portal.

Comprehensive overview

Log into our Corporate Client portal to get an overview, and download all your national and international guarantees, along with your loans.

Made to measure

Are you looking for customised contract wording? We'd be happy to draft individual texts if standardised guarantees won't do.

Our support

We’re there for you if you wish to mandate a second bank with a guarantee (indirect guarantee).

On-site service

We are ready to take care of your guarantee-related needs at seven locations in Germany, as well as in numerous international branches.

Digital Guarantee Management, Multi-guarantor solutions for the efficient management of all guarantees via a single platform

Companies are looking to manage guarantees via a centralised platform – this applies in particular to those that maintain business relationships with several banks. Together with Digital Vault Services GmbH (DVS), we offer our corporate clients precisely such a platform – fast, clear and transparent to

- issue and manage paper-based as well as digital guarantees.

- use a digital repository for the secure custody and management of your guarantees.

- maintain an overview of your guarantee exposure at all times

Find out more, Domestic guarantees offer flexibility

Apply for guarantees and suretyships for your German business online

Hedge your national transactions and improve your liquidity – . We will adapt the guarantees to your needs (regarding contract performance, statutory warranty, lease securities, etc.). If you need several different guarantees, we'd be happy to provide you with a guarantee line that offers high flexibility.

Find out more , Types of international guarantees: characteristics

Guarantees

Guarantees are abstract and irrevocable payment promises by a bank. How clients benefit: clients obtain swift financial compensation for damage caused by non-performance, or insufficient performance, of their contracting party's contractual or payment obligations, by waiving any and all defences and objections arising from the underlying transaction and the relationship between the bank and its principal.

Standby letters of credit

Standby letters of credit fulfil the same purpose as guarantees, and contain similar terms and conditions. Form and presentation are similar to those of documentary letters of credit. The Uniform Customs and Practice for Documentary Credits (UCP) apply accordingly. In contrast to "normal" letters of credit, however, standby letters of credit do not classify as payment instruments.

Bank suretyships

The main difference between bank suretyships on the one side and guarantees and standby letters of credit on the other: suretyships do not qualify as an abstract payment promise, independent from the underlying transaction, but rather as a unilaterally binding contract requiring the surety to stand in for the settlement of the third party's obligations vis-à-vis the creditor. Creditors enter into such suretyship contracts to protect themselves against their debtor's potential insolvency. Differentiation is made between direct and indirect guarantees.

Direct guarantees: the guarantor assumes direct responsibility vis-à-vis the beneficiary.

Indirect guarantees: the principal's bank instructs a second bank to issue a guarantee in favour of the beneficiary, subject to this second bank's counter-indemnity.

Common types of international guarantees, All guarantees have their individual advantages

Tender guarantee

… of a tenderer participating in a tender

Advance payment guarantee

… of an exporter to repay a prepayment

Completion guarantee

… of an exporter regarding full performance of a contract

Performance guarantee

… of an exporter related to their own (quality) guarantees

Payment guarantee

… of an importer, relating to contractual payments

You might also be interested in

Master the challenges of transaction processing with documentary collection or documentary letters of credit

Processing and securing payments in international trade without the banks involved providing an undertaking to pay

Processing and securing payments in international trade with a commitment provided by one or more banks

- 1

Please note that the transactions described in this section are based on guarantees under German law; legal rules outside Germany may differ in terms of substance and/or legal terminology.